montana sales tax rate 2020

The current total local sales tax rate in Yellowstone County MT is 0000. The State of Alabama has a program for simplified sellers use tax SSUT under Statute 40-23-192.

Montana Income Tax Information What You Need To Know On Mt Taxes

Learn more about Montana.

. Lowest and highest sales tax states. Free Unlimited Searches Try Now. The December 2020 total local sales tax rate was also 0000.

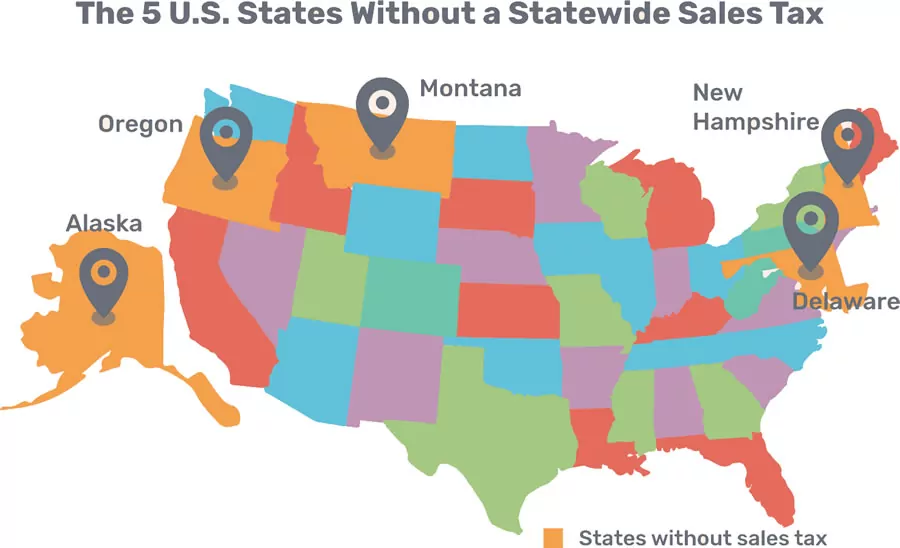

As of July 1 2020. Four states Delaware Montana New Hampshire and Oregon have no statewide sales tax or local sales taxes either. The December 2020 total local sales tax rate was also 0000.

2020 rates included for use while preparing your income tax deduction. There is no vendor allowance allowed against the 4 Lodging Facility Use Tax. 368 rows Average Sales Tax With Local.

Montana has no state sales tax and allows. Montana is one of only five states without a general sales tax. They also provide a guide on the fire.

Learn more about Montana. Yellowstone County MT Sales Tax Rate. The Montana MT state sales tax rate is currently 0.

State. You must pay Montana state income tax on any wages received for work performed while in Montana even if your job is normally based in another state. State State Tax Rate Rank Avg.

Integrate Vertex seamlessly to the systems you already use. A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the nearest 020 and find the row in the. You must pay Montana state income tax on any wages received for work performed while in Montana even if your job is normally based in another state.

The latest sales tax rate for Whitehall MT. The Department of Justice provides several resources about Tobacco product sales in Montana including lists of all tobacco products approved for sale. These rates are weighted by population to compute an average local tax rate.

Montana has a 0 statewide sales tax rate but also has 68 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0002 on top. Within 30 days of exceeding the threshold the remote seller must submit an application to the Louisiana Remote Seller Commission and must begin collecting state and. Sales and Use Tax timely is allowed a 5 vendor allowance against the 4 Lodging Sales Tax.

EBay has collected simplified sellers use tax on taxable transactions delivered into Alabama and the tax of flat eight percent 8 will be remitted on the customers behalf to the Alabama Department of Revenue. Ad Automate Standardize Taxability on Sales and Purchase Transactions. ARM 4214101 through ARM 4214112 and a 4 Lodging Sales Tax see 15- 68-101 MCA through 15-68-820 MCA.

This rate includes any state county city and local sales taxes. Ad Lookup MT Sales Tax Rates By Zip. Local Tax Rate Combined Rate Rank Max Local Tax Rate.

Total Tax Burden by Income Level The estimated burden on a family of three of all personal taxesincome property general sales and auto taxesis provided in the tables below for. Lodging Facility Use Tax see 15-65-101 MCA through 15-65-131 MCA. State Local Sales Tax Rates As of January 1 2020 a City county and municipal rates vary.

State Corporate Income Tax Rates And Brackets Tax Foundation

U S States With No Sales Tax Taxjar

States Without Sales Tax Article

Montana Property Taxes Montana Property Tax Example Calculations

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

States Without Sales Tax Article

Montana State Taxes Tax Types In Montana Income Property Corporate

U S Sales Taxes By State 2020 U S Tax Vatglobal

How High Are Cell Phone Taxes In Your State Tax Foundation

Historical Montana Tax Policy Information Ballotpedia

How To Import A Motorcycle From The Usa To Canada Youmotorcycle

Ebay Sales Tax Everything You Need To Know Guide A2x For Amazon And Shopify Accounting Automated And Reconciled

How Do State And Local Sales Taxes Work Tax Policy Center

States Without Sales Tax Article

Montana Property Taxes Keep Rising But Missoula Isn T At The Top

Montana State Taxes Tax Types In Montana Income Property Corporate

Montana State Taxes Tax Types In Montana Income Property Corporate